Navigating the Landscape: A Guide to Understanding Qualified Opportunity Zones

Related Articles: Navigating the Landscape: A Guide to Understanding Qualified Opportunity Zones

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape: A Guide to Understanding Qualified Opportunity Zones. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape: A Guide to Understanding Qualified Opportunity Zones

The Tax Cuts and Jobs Act of 2017 introduced a novel economic development tool: Qualified Opportunity Zones (QOZs). Designed to spur investment in economically distressed communities across the United States, QOZs offer significant tax benefits to investors who deploy capital in these designated areas. Understanding the nuances of QOZs requires navigating a complex map, both literally and figuratively. This article aims to demystify the concept of QOZs, providing a comprehensive overview of their structure, benefits, and potential impact.

Defining the Landscape: The Qualified Opportunity Zone Map

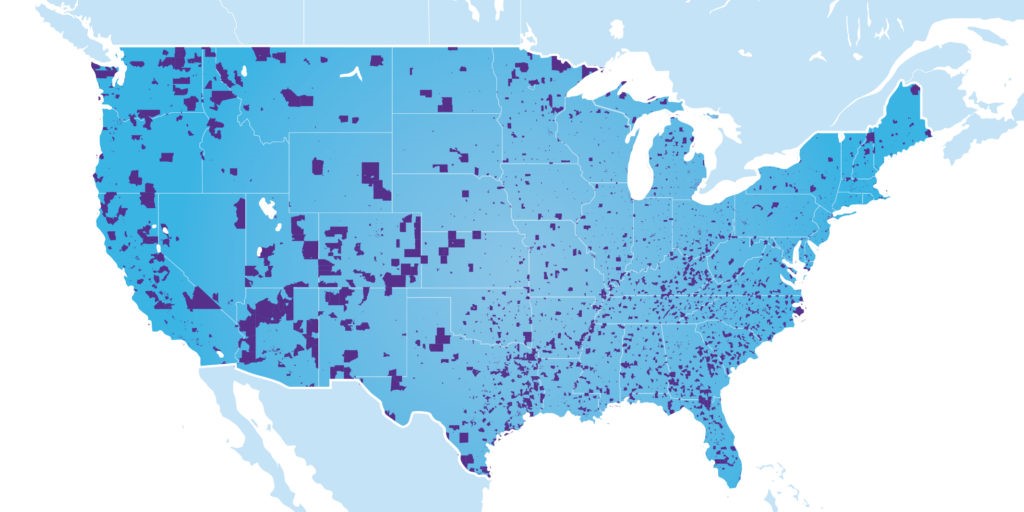

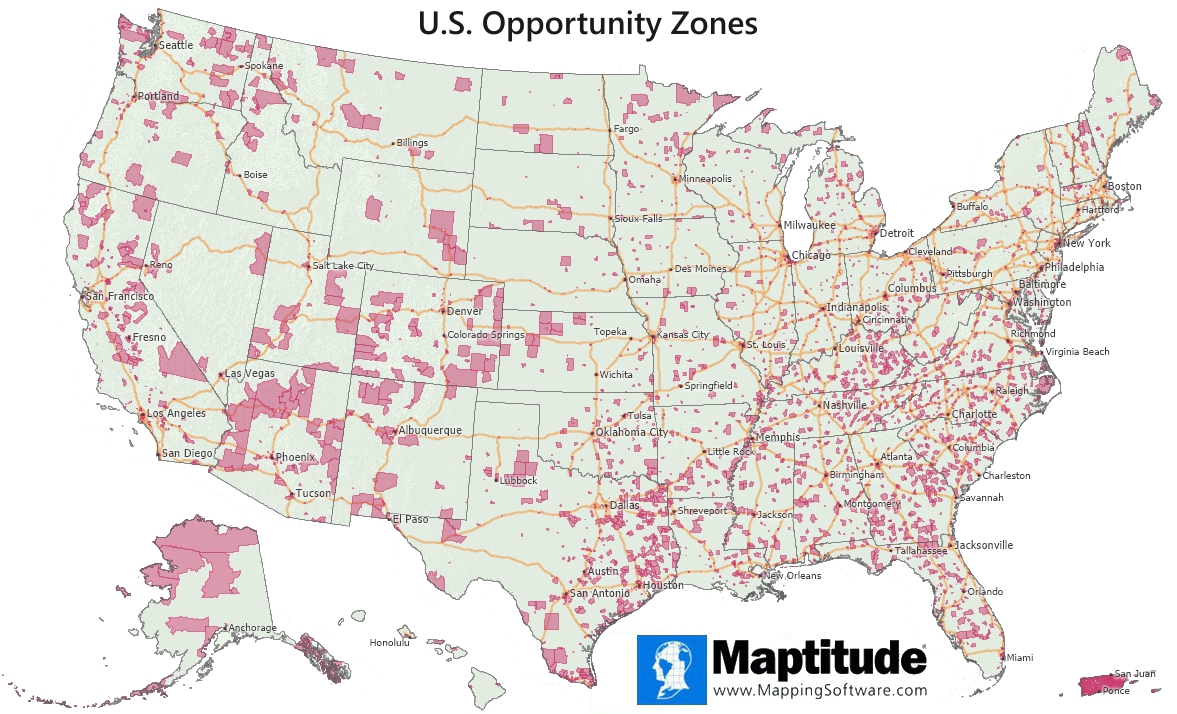

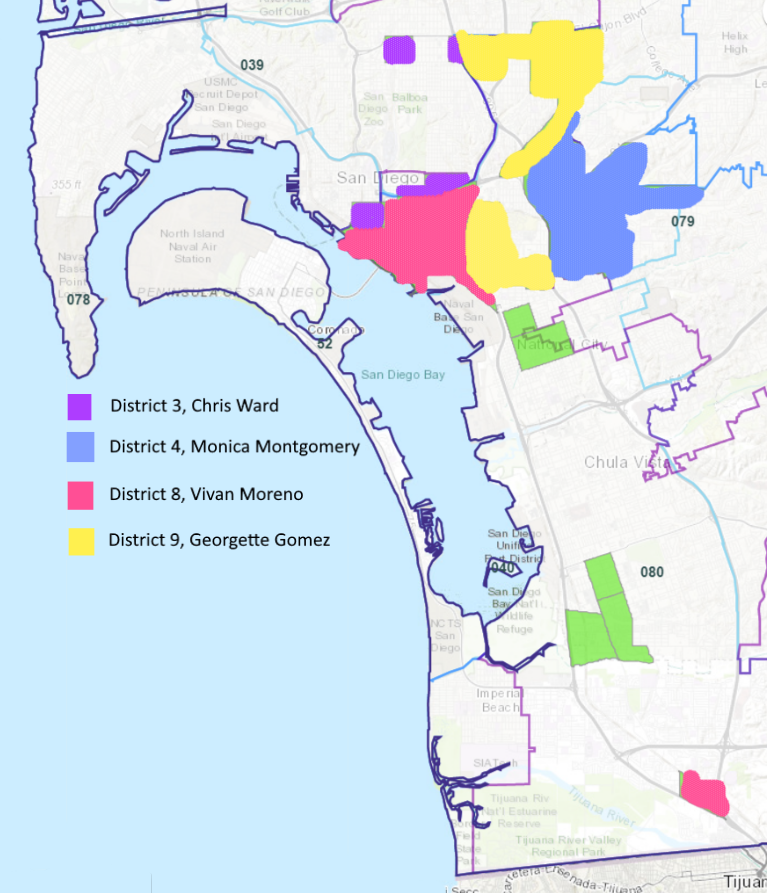

The foundation of the QOZ program lies in the geographical designation of specific areas. The U.S. Treasury Department, in collaboration with state and local governments, identifies census tracts that meet specific criteria for economic distress. These tracts are then designated as Qualified Opportunity Zones, forming a network of eligible investment areas across the country.

The map of QOZs serves as a visual representation of this network. It is a crucial tool for investors, developers, and community stakeholders seeking to understand the potential of the program and identify specific areas for investment. The map visually highlights the geographical scope of the program, allowing individuals and organizations to pinpoint opportunities within their region or across the nation.

Understanding the Benefits: Incentives for Investment

The QOZ program incentivizes investment in distressed communities by offering tax advantages to investors. These benefits are structured to encourage long-term capital deployment, fostering economic growth and job creation within designated areas.

Key Benefits of Investing in QOZs:

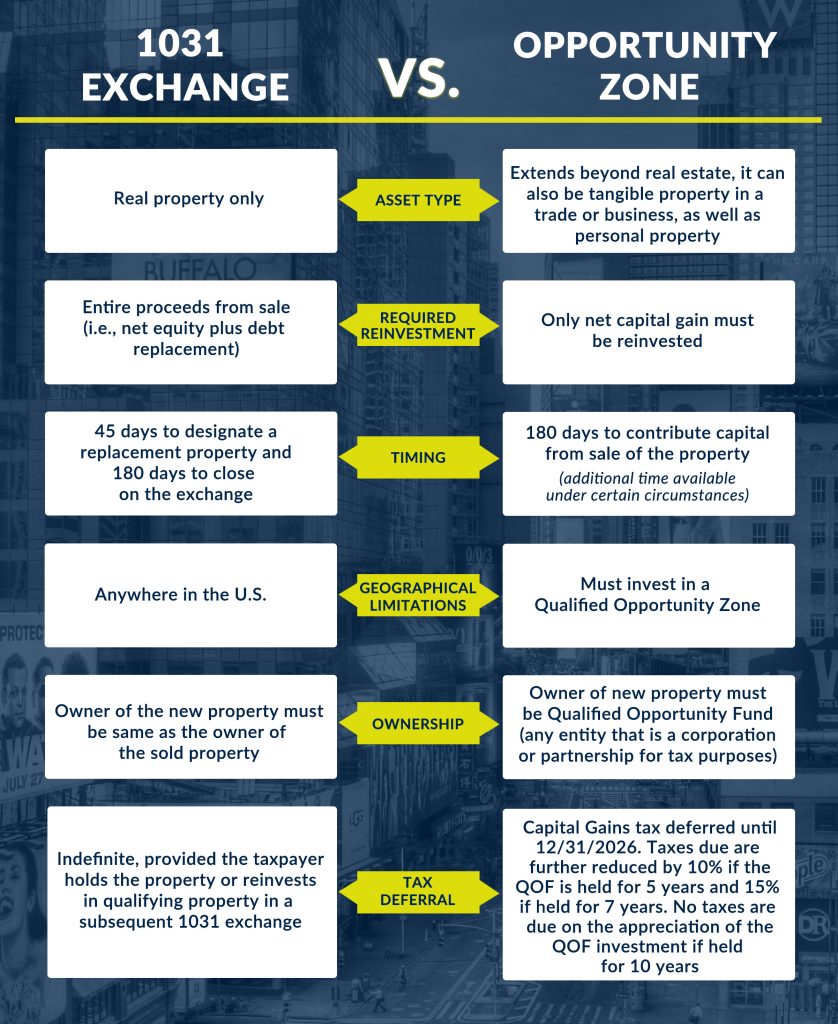

- Capital Gains Tax Deferral: Investors can defer capital gains tax liability on investments made in QOZs until the earlier of December 31, 2026, or the date the investment is sold.

- Capital Gains Tax Reduction: If an investment is held for at least ten years, investors can realize a 100% reduction in capital gains tax liability.

- Step-Up Basis: Investors can receive a step-up basis in their QOZ investment, effectively lowering future capital gains taxes on any appreciation in the investment.

Navigating the Program: A Guide for Investors

Investing in QOZs is a complex process requiring careful consideration and strategic planning. Here’s a step-by-step guide to navigating the program effectively:

- Identify Eligible Investments: Investors need to identify projects or businesses within designated QOZs that align with their investment goals. This can involve researching specific projects, connecting with developers, or exploring opportunities through QOZ funds.

- Establish a Qualified Opportunity Fund (QOF): Investors can invest directly in QOZ projects, or they can choose to invest through Qualified Opportunity Funds (QOFs). QOFs are specifically designed to invest in QOZs, offering investors a streamlined approach to accessing the program’s benefits.

- Comply with Program Requirements: Adhering to the program’s specific requirements is crucial for maximizing tax benefits and avoiding potential penalties. These requirements include minimum investment holding periods, restrictions on certain types of investments, and reporting obligations.

- Seek Professional Guidance: Engaging financial advisors, tax professionals, and legal experts experienced in QOZ investing can be invaluable in navigating the complexities of the program and ensuring optimal investment outcomes.

FAQs: Addressing Common Queries

Q: Who can invest in QOZs?

A: Any individual or entity subject to U.S. tax laws can invest in QOZs. This includes individuals, corporations, partnerships, trusts, and estates.

Q: How do I find QOZs in my area?

A: The U.S. Treasury Department maintains an interactive map of designated QOZs on its website. You can use this map to identify QOZs in your region or search for specific areas of interest.

Q: What types of investments are eligible for QOZs?

A: Eligible investments include a wide range of projects, including real estate development, business expansions, infrastructure improvements, and community development initiatives.

Q: Are there any limitations on investments in QOZs?

A: Yes, there are certain restrictions on eligible investments. For example, investments in publicly traded securities are generally not eligible for QOZ benefits.

Q: What are the tax reporting requirements for QOZ investments?

A: Investors must report their QOZ investments on their federal income tax returns. The IRS provides specific forms and instructions for reporting QOZ investments.

Tips for Success: Maximizing Investment Potential

- Conduct Thorough Due Diligence: Before investing in QOZs, it is crucial to conduct comprehensive due diligence on the project or fund. This includes evaluating the project’s feasibility, the developer’s track record, and the potential for economic impact.

- Seek Expert Advice: Engaging experienced professionals with expertise in QOZs can provide valuable insights and guidance throughout the investment process.

- Consider Long-Term Investment: The QOZ program is designed to encourage long-term investment. Investors should carefully consider their investment horizon and ensure they are comfortable with the potential for longer-term returns.

- Monitor Investment Performance: Regular monitoring of investment performance is essential for ensuring the success of QOZ investments. This includes tracking progress on project milestones, analyzing financial data, and assessing the overall impact on the community.

Conclusion: A Catalyst for Economic Revitalization

The Qualified Opportunity Zone program presents a unique opportunity for investors to generate tax benefits while contributing to the revitalization of economically distressed communities. By understanding the program’s structure, benefits, and requirements, investors can navigate the complex landscape of QOZs effectively. The program’s success hinges on the collaboration of investors, developers, community leaders, and government agencies working together to unlock the potential of these designated areas. As the QOZ program matures, its impact on economic development, job creation, and social equity will continue to be closely observed and analyzed.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape: A Guide to Understanding Qualified Opportunity Zones. We appreciate your attention to our article. See you in our next article!